After you have repaired your credit, you need to monitor your credit monthly to maintain a stable, high credit score, Clean History, and strong credibility. By choosing one of the following packages, your credit will always remain ready for purchase when you decide to take action. Decide to buy and use your credit line instead of paying.

With our comprehensive Credit Monitoring services, we keep you informed of every change to your credit profile. From monitoring score fluctuations to alerting you about potential risks, our packages offer the perfect balance of real-time updates, detailed progress reports, and expert guidance. Whether you're just starting or aiming to maintain a high score, we provide the tools and insights you need to protect and improve your credit. At KBR, we understand that managing your credit can be overwhelming. Our Credit Monitoring service allows you to focus on your financial goals while we handle the details.

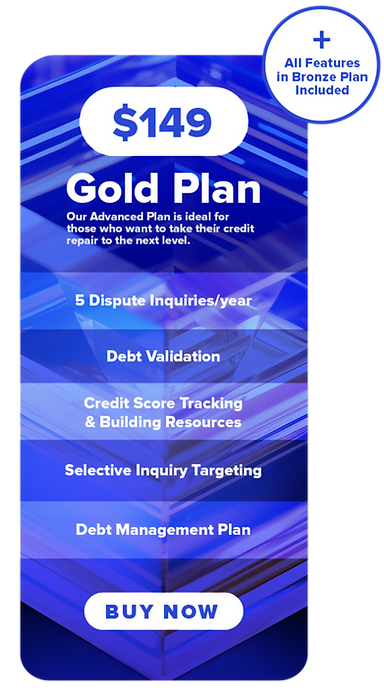

Our team will conduct a detailed analysis of your credit profile for a $149 one-time consultation fee. You’ll receive a comprehensive assessment of your credit situation and specialized advice to guide you in choosing the best plan for your credit repair. Then you can also take advantage of our monthly packages to consistently maintain and enhance your credit status.

We will provide you with access to our portal to complete the signup process. Which consists of signing up for credit monitoring, providing us access to your credit monitoring, selecting a plan, signing the agreement, and providing us with your credit card information. You will be charged $0 after completing the signup process and scheduling a consultation call with your credit repair expert inside our client portal for security purposes.

Step 2: Consultation

During the consultation call, we will provide you with a complete review of your credit audit and discuss the action plan moving forward based on your selected plan. You can always change your plan or cancel at any point in time. If you move forward and choose to do business with us, then…

Step 3: Monthly Dispute and review

During the consultation call, we will provide you with a complete review of your credit audit and discuss the action plan moving forward based on your selected plan. You can always change your plan or cancel at any point in time. If you move forward and choose to do business with us, then…

Be Compliant; nothing else matters!

We follow the rules:

Example:

Signup Today: 10/01/2024

Credit Consultation is scheduled for 10/02/2024

If you agree to purchase the service on 10/02/2024

Then, 7 days later, on 10/08/2024, we will invoice and charge you for the Credit Consultation.

Terms:

Dispute Management

Credit Reports

Identity Theft

Score Tracking

Fraud Alerts

9631 W Olympic Blvd,

Beverly Hills, CA 90212

© 2024 KBR Financial Group® LLC, All rights are reserved. The product name, logo, brands, and other trademarks mentioned in KBR Financial Group® belong to their respective trademark holders. Compensation may be received through third-party advertisers on this site. Any reproduction, distribution, or copying of any part of this site is strictly prohibited without prior written permission. The availability of services from KBR Financial Group® and its affiliates may vary by state. KBR Financial Group® assists consumers in addressing inaccuracies, misleading information, unverifiable data, untimely reports, incomplete details, or any other incorrect information in credit reports. Individual results may vary.